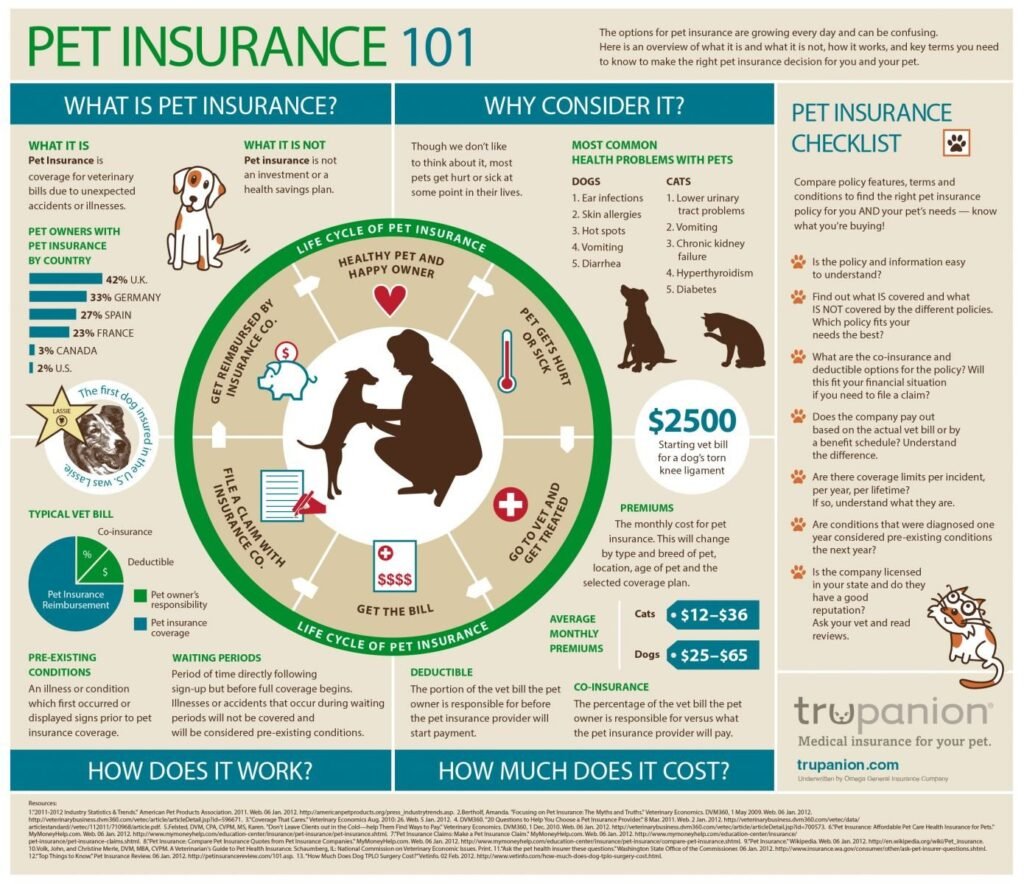

Even simple vet bills are expensive and add up fast! TRUPANION has no veterinary networks, we’re working to reduce the amount of paperwork pet owners need to file, and on average we reimburse claims faster than any other pet insurance company. Plus your pet gets coverage for all unexpected injuries and illnesses.

If you’re still unsure about the value of pet insurance, consider that in the United States, a pet receives emergency medical care every 2.5 seconds.

1 out of 3 pets needs emergency care each year.

In addition, every 6 seconds an owner is faced with a vet bill of more than $3,000. With the rising cost of veterinary care and pets going to the vet more frequently, the benefits of pet insurance are becoming increasingly advantageous.

ONE SIMPLE PLAN

All pets get the best coverage we have to offer under our one simple plan.

VET DIRECT PAY

TRUPANION will pay your bill directly to your veterinarian—just pay your portion and they take care of the rest.

NO PAYOUT LIMITS

TRUPANION gives unlimited lifetime insurance coverage without caps.

90% COVERAGE

TRUPANION’S plan covers 90% of actual veterinary costs for eligible claims once you meet the deductible.

Terms and conditions apply. See the full policy for details.

ANY VETERINARIAN

TRUPANION has you covered at any clinic, emergency hospital, or specialty center

ANYWHERE

TRUPANION has you covered at any veterinarian in the United States, Canada, and Puerto Rico. You don’t have to wait on a reimbursement check, because TRUPANION can pay your veterinarian directly.

Examples:

Elbow and hip dysplasia

Diabetes

Upper respiratory infections (URI)

Thyroid disease

Examples:

Vomiting

Diarrhea

Cough

Change in weight

Examples:

Heart disease

Nervous system issues

Cataracts

Liver disease

Exam fees and sales tax (where applicable)

Spay or neuter

Preventive care (vaccinations, fleas and tick control, dental chews, etc.)

Pre-existing conditions — Please know that the policy isn’t designed to cover the things that happened before you become a member. Conditions that showed signs during waiting periods or before enrollment are considered pre-existing and are not eligible for coverage.